STRATEGY

Since founding our family office in 2012, MMA has leveraged over 50 years of industry experience and relationships to develop a premium national U.S. real estate investment platform.

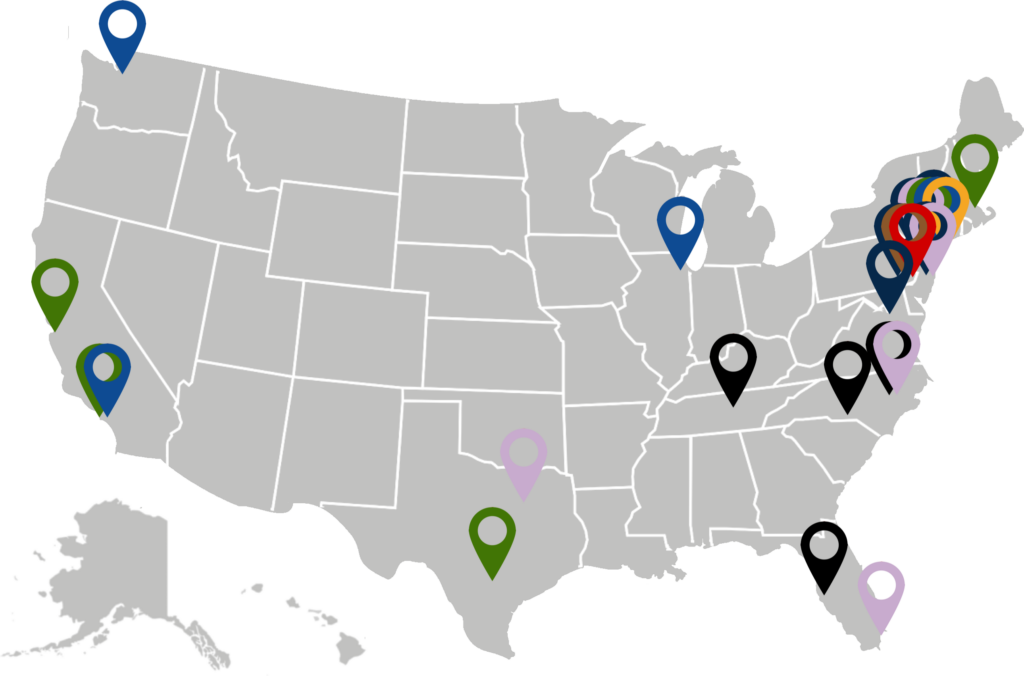

We focus primarily on multifamily and residential mixed-use value-add & opportunistic deals sourced through our network of high-performing Operators with local expertise in select primary and high-growth urban markets across the United States.

We take a comprehensive portfolio management approach, grounded in analytics, to position us to better absorb unforeseen impacts and make better decisions when faced with rapidly changing deal or market dynamics.

By combining top-notch local access and expertise with national reach and hands-on portfolio management, MMA is able to curate attractive portfolios at every stage of the Real Estate Cycle.

We Work With Partners Who Bring Regional Expertise And Access To Each Deal.

Select each partner name below to learn more.

Underwriting Strategy

In our experience, a successful investment begins with choosing the right local Operators with the knowledge, expertise and relationships to consistently develop & execute business plans that create value for investors and the community in which they operate.

Our partnerships typically begin through trusted introductions in markets that MMA has identified as having favorable market drivers for real estate value creation that fit well within MMA’s investment focus and portfolio strategy.

After a rigorous underwriting of the market and operator, that includes alignment of values and investment thesis, the project-by-

project underwriting and negotiating process becomes more favorable and efficient.

Special attention to selecting the right operators as pipeline partners positions MMA to build a diversified, national portfolio with localized expertise, balancing specialization and diversification.

In turn, MMA is able to add value beyond asset-level performance, including reduced operating costs, competitive deal structuring, advanced portfolio analytics, risk management, investor advocacy & oversight, accelerating exit strategies and more, aimed at enhancing risk-adjusted returns.

Our Operating Partners

The operating partners we work with.

Blue Heron Asset Management

Geographical Focus:

The Southeast, with a focus in Raleigh-Durham, Charlotte, Nashville, Tampa Bay

Strategy:

Value-Add & Development

Asset class:

Multifamily, Office & Mixed-Use

Investment Type:

Equity

Cottonwood Group

Geographical Focus:

National, with a focus in LA, San Francisco, San Antonio, Dallas, Boston, New York

Strategy:

Distressed, Value-add, Repositioning & Development

Asset class:

Residential, Mixed-Use, Industrial & Hospitality

Investment Type:

Senior, Subordinated, Mezz Debt & Equity

Harbor Group International

Geographical Focus:

National, with a focus in New York, New Jersey, Miami, Dallas, Raleigh-Durham

Strategy:

Value-Add & Repositioning

Asset class:

Retail, Office & Multifamily

Investment Type:

Equity, Whole Loan, Mezz Debt

The How Group

Geographical Focus:

Philadelphia, PA

Strategy:

Repositioning & Development

Asset class:

Residential & Mixed-Use

Investment Type:

Equity

Raza Homes

Geographical Focus:

Philadelphia, PA

Core Strategy:

Redevelopment

Asset class:

Single Family Homes, Multifamily

Investment Type:

Equity, Promissory Note

Six Peak Capital

Geographical Focus:

New York, LA, Seattle, Chicago

Strategy:

Development & Redevelopment

Asset class:

High-density Multifamily

Investment Type:

Equity

Tavros Capital

Geographical Focus:

New York City

Strategy:

Repositioning & Development

Asset Class:

Residential & Mixed-Use

Investment Type:

Equity, Convertible Note

The Benefits of Private Equity Real Estate Investing, Done Right.

Why Invest in Real Estate?

Real estate offers the opportunity to earn steady cash flow from rental income as well as capital appreciation over the long-term with low correlation to other real assets or marketable securities. Real estate tends to yield more predictable returns with less volatility than most other private market asset types. Unlike stocks and bonds, real estate serves as a hedge against inflation, as rents and home prices tend to rise with inflation. In addition, real estate investments often entail various tax shelters that in some cases can reduce tax current and long-term tax liabilities. All of which make real estate an excellent diversifier that can help improve the overall risk-return performance of an investment portfolio.

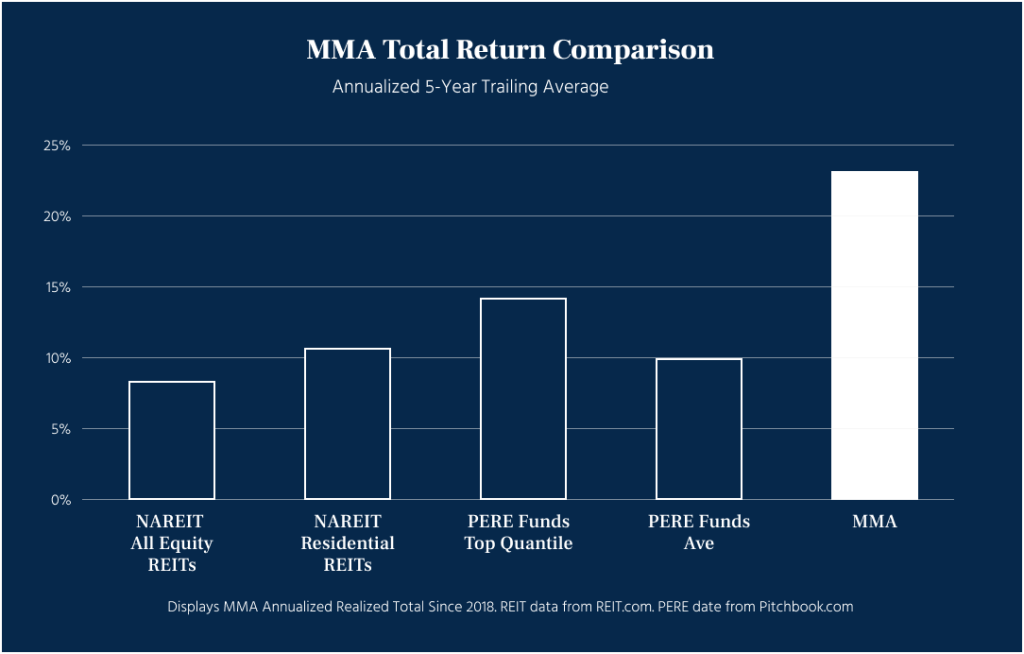

Why Invest in Private Equity Real Estate vs REITs?

While Real Estate Investment Trusts (REITs) also offer cash flow income in the form of dividends as well as the potential for moderate, long-term capital appreciation, the long-term total returns of REIT stocks tend to be similar to those of value stocks. Although they can be a good diversifier within a stock portfolio, typically offering higher total returns than bonds and relatively low correlation compared to equities, the top quintile of Private Equity Real Estate funds in the U.S. have historically offered higher total returns and lower correlation with equities than REITs.

Why MMA?

Through our two main private real estate fund offerings, MMA Capital Partners and MMA Fund Partners, MMA takes an active portfolio management approach to deliver attractive risk-adjusted returns to investors over the long-term, while providing steady current income distributions. Since 2012, MMA has outperformed NAREIT benchmarks and generated annualized Total Returns within the top quintile of Private Equity Real Estate Funds in the U.S. over the last five years.

MMA Advantage

Premium Pipeline

MMA sources deals through an established network of highly vetted, tried and true operating partners with specializations in complimentary target markets, asset types and strategies.

Portfolio Management

MMA provides investors with asset allocations that are balanced in real-time, corresponding to current market conditions and outlooks, positioning the portfolio to achieve attractive, risk-adjusted returns through different stages of the real estate market cycle.

Better Terms

MMA leverages long-term relationships and investment capacity to negotiate favored LP or Co-GP terms with Sponsors, including reduced deal-level fees, major-decision rights, and promote-share or other fee-income agreements that enhance risk-adjusted returns to MMA LPs.

More Skin in the Game

As a General Partner, MMA typically invests >10% of aggregate capital commitments per investment offering, well above the industry standard of ~1%.

Advocacy & Oversight

MMA is often able to accelerate the exit timing of certain assets that are otherwise illiquid at the asset-level by facilitating the assignment or recapitalization of its interests through its network or by leveraging its long-standing relationship with operators to negotiate catered exit strategies.

Reduced Operating Costs

MMA Funds benefit from the industry, banking, operational and capital resources of the MMA family office, allowing it to operate optimally with minimal operating expenses, with an average annualized operating expense ratio of under 1.5% since 2018.

Risk Management

Strict investment guidelines limit exposure to a single geography, asset class or Sponsor to safeguard investor capital and position our portfolio to weather any storm. Fund investment decisions are reviewed by an Investment Committee comprised of Non-Executive Directors.

Access & Diversification

All MMA investment deals are otherwise closed for direct investment, are only accessible on a standalone basis, are accessible at inferior terms, or have a higher minimum investment threshold compared to MMA offerings.